Main Menu

Product

MyProfile

Hi, Sahabat MyProtection!

Selain menjaga Anda dan keluarga dari kejadian tak terduga di masa depan, Perlindungan Kesehatan Prima juga mempermudah proses berobat Anda! Fitur klaim cashless & cardless membuat kunjungan ke rumah sakit lebih mudah dan praktis. Fitur cashless & cardless artinya Anda tidak perlu mengeluarkan uang tunai atau repot membawa kartu fisik untuk berobat di rumah sakit rekanan MyProtection. Wah, praktis sekali, kan?

Perlindungan Kesehatan Prima juga memiliki satu fitur unggulan yaitu Saldo Prima. Melalui Saldo Prima, Anda bisa membeli obat atau vitamin tanpa perlu berobat ke dokter. Sehingga pembelian obat atau vitamin Anda bisa digantikan.

Kabar baiknya, premi Perlindungan Kesehatan Prima hanya mulai dari Rp 6 ribuan/hari atau Rp 3,5 jutaan/tahun. Anda bisa mendapatkan manfaat rawat inap & bedah hingga Rp 100 juta. Terdapat juga pilihan cicilan 12 bulan dengan bunga 0% dengan kartu kredit tertentu.

Tunggu apalagi?

Anda bisa pelajari lebih lanjut untuk melihat brosur produk dan simulasi harga atau beli sekarang

Butuh informasi lebih lanjut? Silakan menghubungi Call Center MyProtection di 0804-133-888 atau email ke cs@myprotection.com

Hi, Sahabat MyProtection!

Kalau berbicara soal keuangan pribadi, kita pastinya sering mendengar ajakan untuk menabung dan berinvestasi. Namun, selain menabung dan berinvestasi, ada beberapa hal yang perlu kamu waspadai mengenai kebiasaan keuanganmu.

Comfort zone, sesuai dengan namanya, memang rasanya nyaman. Kamu bisa menjalani kegiatan familiar di lingkungan yang familiar, baik itu dalam menjalankan usaha atau bekerja kantoran. Rasanya aman. Hanya saja, terkadang kita terlena dalam comfort zone yang menghambat kita untuk semakin maju, baik secara bisnis, karier, maupun keuangan karena stuck di posisi yang sama terlalu lama. Perubahan memang ngga enak, tapi terkadang diperlukan.

Dodi merupakan kepala keluarga sekaligus karyawan di sebuah perusahaan swasta. Gaji bulanan Dodi adalah sumber pendapatan tunggal untuk membayar berbagai tagihan. Namun, suatu saat Dodi harus mengalami PHK dan menganggur hingga beberapa bulan. Dengan mengandalkan gaji sebagai satu-satunya income, maka keuangan Dodi terancam terganggu jika ia berhenti bekerja. Untuk menghindari skenario yang Dodi alami, kita dianjurkan untuk memiliki sumber pendapatan lebih dari satu. Sehingga jika satu sumber income mengalami hambatan, kamu tetap memilik dana cadangan dari pendapatan lain. Misalnya lewat berinvestasi, membuka usaha kecil-kecilan, atau freelance.

Mungkin kamu pernah merasakah hal yang sama, pendapatan naik, tapi tabungan kok rasanya tidak bertambah, ya? Ternyata, mengatur keuangan itu bukan cuma sekadar rajin menabung dan berinvestasi saja, Sahabat MyProtection. Mengatur keuangan itu artinya kamu belajar membuat rencana pengeluaran yang tepat, target finansial di masa depan, termasuk cermat dalam menghadapi risiko di masa depan dengan tabungan dan asuransi.

Tertarik dengan artikel sejenis? Kamu bisa cek tips berbenah keuangan pribadi di sini.

Salam,

Sahabat MyProtection

Desa wisata merupakan sebuah wilayah maupun kawasan yang dijadikan tempat rekreasi bagi turis dan wisata yang dikembangkan.

Sama dengan tempat wisata lainnya, wilayah ini menawarkan berbagai daya tarik bagi para pengunjung hingga aksesibilitas yang terintegrasi dengan berbagai tata cara serta tradisi masyarakat di daerah tersebut.

Desa wisata merupakan sebuah kawasan pedesaan yang dijadikan destinasi wisata yang menawarkan suasana desa asli dari berbagai segi, mulai dari ekonomi, sosial budaya, adat istiadat, keseharian, hingga arsitektur bangunannya.

Serupa dengan tempat wisatanya yang lain, desa wisata memiliki potensi besar jika dikembangkan dengan baik, mulai dari segi atraksi, akomodasi, makanan serta minuman, dan berbagai kebutuhan lainnya.

Tujuan desa dijadikan tempat wisata sendiri adalah untuk memberdayakan masyarakat desa sekitar. Selain itu, pembangunannya sendiri memiliki tujuan lain, seperti mendukung program pariwisata pemerintah, memperluas lapangan pekerjaan, hingga meningkatkan kesejahteraan warga desa.

Pembangunan desa sendiri memiliki banyak tujuan, oleh sebab itu pembangunannya harus direncanakan secara matang. Berikut apa saja tujuannya:

Mendukung program pariwisata pemerintah dengan memberikan dan menyediakan objek wisata alternatif.

Menggali potensi yang dimiliki desa untuk membangun masyarakat sekitar.

Masyarakat sekitar memiliki kesadaran lebih atas potensi yang dimiliki desanya, sehingga mampu bekerja lebih keras untuk mengembangkannya.

Memperbanyak dan memperluas lapangan pekerjaan bagi masyarakat sekitar sehingga mampu meningkatkan kesejahteraan dan kualitas hidupnya.

Menahan laju urbanisasi.

Menimbulkan rasa bangga dari dalam diri warga desa setempat akan tempat tinggalnya.

Mempercepat proses pembauran bagi penduduk non pribumi dengan penduduk pribumi.

Memperkokoh persatuan bangsa yang dapat membantu untuk mengatasi disintegrasi.

Desa wisata sendiri memiliki karakteristiknya masing-masing berdasarkan faktor yang ditawarkan. Simak beberapa karakteristiknya berdasarkan potensi yang dimiliki:

Desa dengan lingkungan alamnya yang indah pada umumnya memiliki karakteristik berikut:

Keindahan alam

Jenis sumber daya alam yang unggul dan menonjol untuk dijadikan kegiatan wisata

Keunikan sumber daya alam dibandingkan dengan wilayah lain

Desa dengan wisata ekonomi maupun mata pencaharian yang dapat dijadikan tempat pariwisata memiliki karakteristik berikut:

Mata pencaharian utama dari warga sekitar dapat dikembangkan menjadi atraksi wisata

Kurangnya tingkat pengangguran masyarakat desa sekitar

Pemerataan yang berhubungan langsung dengan investasi lokal

Desa dengan kehidupan adat atau seni budaya yang dapat dijadikan tempat pariwisata memiliki karakteristik berikut:

Adanya tata adat tradisional yang sangat kental dan mendominasi kehidupan masyarakat sekitar

Pengelolaan kegiatan seni budaya yang berlangsung di desa secara langsung dilakukan oleh masyarakat sekitar

Kehidupan masyarakat memiliki keunikannya tersendiri ataupun tata cara kehidupan tradisional masih terjaga

Desa dengan bangunan tradisional yang dapat dijadikan tempat pariwisata memiliki karakteristik berikut:

Memiliki bangunan tradisional yang khas dan unik

Memiliki arsitektur lokal yang sangat mendominasi

Memiliki struktur tata ruang yang khas

Memiliki pola serta material bangunan yang alami dan melambangkan unsur keunikan dan keaslian lokal.

Dari banyaknya desa di Indonesia, berikut ini ada beberapa contoh desa wisata yang dapat kamu kunjungi dengan keunikan dan keunggulannya masing-masing.

https://atourin.com/destination/malang/desa-wisata-pujon-kidul

Desa Pujon Kidul merupakan desa wisata yang berlokasi di Malang tepatnya di Kecamatan Pujon yang berjarak sekitar 30-kilometer dari pusat Kota Malang.

Dengan berbagai aktivitas menarik di desa ini dan lokasinya di dataran tinggi yang masih sejuk dan asri memberikan daya tariknya tersendiri. Ada apa saja aktivitasnya?

ATV, di desa ini pengunjung dapat menyewa ATV untuk menjelajahi setiap sudut tempat wisata ini tanpa harus berjalan kaki dan menikmati aktivitas menantang memacu adrenalin.

Wisata alam dan edukasi, di desa ini para pengunjung juga bisa secara langsung berinteraksi sekaligus belajar terkait alam sekitar. Mulai dari melihat secara langsung proses beternak, bertani, serta berbagai aktivitas alam lainnya.

Berkuda, di desa Pujon Kidul para pengunjung juga dapat menikmati dan mengeksplorasi alam sekitar dengan berkuda.

Cafe dengan pemandangan sawah, kafe dengan pemandangan khas desa yang asri, di kafe ini para pengunjung bisa menyantap hidangan lokal dan dapat secara langsung aktivitas di sawah terjadi, seperti petani menggarap sawah.

Petik buah stroberi, aktivitas yang juga wajib para pengunjung coba adalah memetik buah stroberi yang dapat dilakukan dengan peralatan lengkapnya, mulai dari gunting, topi, hingga keranjang.

Bukan hanya aktivitas di atas saja, di desa Pujon Kidul para wisatawan juga dapat menanam sayuran, memetik sayuran, atau bahkan memerah susu sapi secara langsung.

https://alodiatour.com/desa-wisata-pentingsari/

Desa Pentingsari yang berlokasi di Yogyakarta tepatnya di Dusun Pentingsari, Desa Umbulharjo, Kecamatan Cangkringan, Kabupaten Sleman yang sudah dikenal para wisatawan baik lokal maupun mancanegara.

Desa wisata ini juga telah berhasil memenangkan banyak penghargaan, seperti masuk ke dalam 100 besar destinasi berkelanjutan versi Global Green Destination Days atau GGDD.

Di sini, para wisatawan dapat melakukan berbagai hal yang unik dan pastinya seru sambil mempelajari alam sekitar, seperti pertanian, perkebunan, kewirausahaan, kehidupan sosial budaya, hingga beragam seni tradisional.

Terdapat beberapa program wisata yang dapat pengunjung lakukan, mulai dari live in, trekking, outbound dan masih banyak lagi.

Bagi sahabat MyProtection yang lebih menyukai kegiatan dengan unsur budaya, di desa Pentingsari juga ada, yaitu mempelajari cari bermain alat musik gamelan, menari, membatik, membuat wayang rumput, hingga membuat janur.

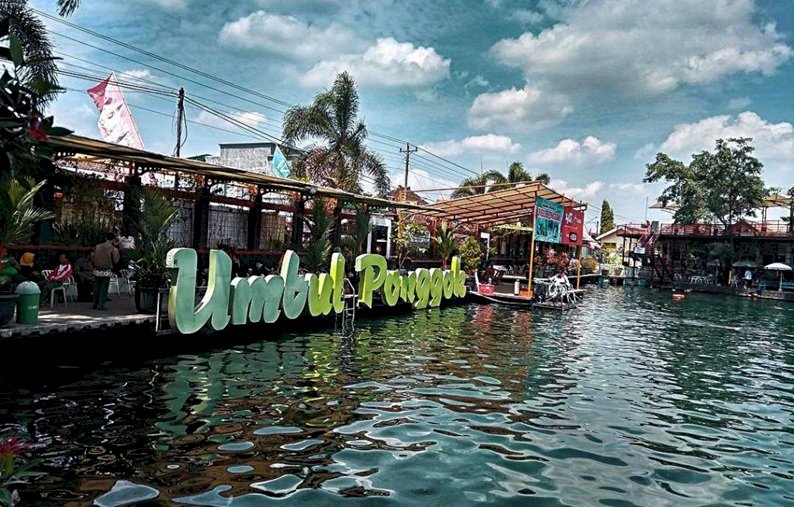

https://web.dpmptsp.klaten.go.id/desa-wisata-ponggok-kecamatan-polanharjo

Desa Ponggok yang terkenal sebagai objek wisata yang memiliki 5 sumber mata air menjadi salah satu incaran wisatawan untuk dikunjungi.

Terletak di Kecamatan Polanharjo, desa Ponggok ini menghadirkan berbagai objek wisata air, mulai dari berenang, snorkeling, menyelam, atau bahkan berfoto di bawah air.

Terdapat beberapa objek wisata di desa Ponggok yang wajib kamu ketahui, simak di sini!

The Honduras, yang terletak di Jalan Raya Area Kebun/Sawah, Ponggok, Polanharjo, Klaten dan sudah resmi dibuka sejak Juli 2023. The Honduras menyuguhkan berbagai fasilitas, mulai dari kolam, gazebo, dan berbagai spot foto menarik seperti menara maupun mercusuar.

Soko Alas, yang menyuguhkan wahana megah dengan pemandangan indah berupa sawah dan embung yang luas.

Umbul Sigedang, yang berlokasi di Dukuh Umbulsari, Desa Ponggok, Polanharjo, Klaten dengan keindahan kolam air yang jernih serta pohon beringin yang menjalar di sekitar kolam.

Umbul Besuki, merupakan objek wisata yang berlokasi di Dukung Kiringan, Desa Ponggok, Polanharjo, Klaten. Wisaya ini terdiri dari beberapa kolam yang dapat dipakai berenang, pendapa, outbound, hingga camping.

Water Gong, objek wisata air yang berlokasi di perbatasan Desa Ponggok dengan Desa Karanglo yang sempat viral karena menjadi tempat wisata yang unik dan menarik.

https://wonderfulimages.kemenparekraf.go.id/read/520/menyusuri-desa-adat-kete-kesu

Selanjutnya, Desa Kete Kesu yang menjadi desa tertua di Sanggalangi dengan usia mencapai 400 tahun yang di dalamnya berisikan berbagai tradisi unik dari masyarakat Toraja.

Pada desa ini terdapat jajaran rumah adat Tongkonan yang sudah berusia lebih dari 300 tahun dan saat ini ditempati sekitar 20 keluarga.

Rumah Tongkonan sendiri memiliki keunikannya tersendiri, yaitu atap yang berbentuk perahu, dan berdasarkan masyarakat Toraja hanya masyarakat berdarah bangsawan saja yang boleh membangun dan tinggal di dalamnya.

Salah satu rumah juga dijadikan museum di mana para wisatawan dapat berkunjung dan melihat benda-benda bersejarah, keramik Tiongkok, patung, belati, parang, serta bendera pertama yang dikibarkan di Toraja.

Di desa ini para wisatawan juga dapat berkunjung ke bukti yang merupakana situs pemakaan kuno yang berusia lebih dari 700 tahun dan selama perjalanan sahabat MyProtection dapat melihat tengkorak dan tulang manusia berserakan.

Bali yang memiliki daya tarik turis tinggi karena keindahan pantainya, pesona bawah laut, hingga budayanya ternyata memiliki desa wisata yang tidak kalah populer, yaitu Desa Penglipuran yang berlokasi di Kabupaten Bangli, Bali.

Apa saja yang menjadi daya tarik dari Desa Penglipuran ini? Simak di sini!

Desa terbersih di dunia, menjadi salah satu dari tiga desa yang dinobatkan sebagai desa terbersih di dunia, Desa Penglipuran juga telah mendapatkan beberapa penghargaan, mulai dari Kalpataru, ISTA di tahun 2017, hingga Sustainable Destinations Top 100 versi Green Destinations Foundation.

Tata ruang desa berkonsep Tri Mandala, di mana tata ruang desa dibagi ke dalam tiga wilayah, yaitu Utama Mandala, Madya Mandala, serta Nista Mandala.

Hutan bambu dengan luas hingga 45 hektare atau sekitar 40 persen dari keseluruhan luas Desa Penglipuran. Bukan hanya karena keindahannya saja, tapi hutan bambu menjadi kawasan resapan air yang membuatnya terus dijaga dan dilestarikan.

Ritual keagamaan, Ngusaba yang dilakukan guna menyambut Hari Raya Nyepi yang sudah diajarkan oleh para tetua adat dan menjadi ajaran yang diwariskan dari para leluhur.

Kuliner unik, seperti loloh cemcem serta tipak cantok. Loloh cemcem yang merupakan minuman khas dari daun cemcem yang digunakan untuk melancarkan pencernaan. Sedangkan, tipak cantok yang merupakan ketupat dan sayuran rebus yang disajikan dengan bumbu kacang.

Penglipuran Village Festival, yang diselenggarakan di akhir tahun dengan berbagai rangkaian kegiatan, seperti parade pakaian adat Bali, Barong Ngelawang, parade seni budaya, dan berbagai lomba lainnya.

https://pariwisata.situbondokab.go.id/wisata/ekowisata-kampung-blekok

Kampung Blekok yang berlokasi di Kabupaten Situbondo, kampung ini bukan hanya menjadi destinasi wisata saja, namun juga menjadi kawasan konservasi bakau atau mangrove.

Terdapat beberapa daya tarik atau atraksi pada Kampung Blekok yang harus kamu datangi saat kesini:

Ragam burung air, Kampung Blekok menjadi kawasan bakau yang dihuni oleh burung air jenis ardidae atau yang dikenal juga dengan sebutan burung blekok.

Kerajinan tangan masyarakat sekitar yang dikenal karena keindahannya. Seperti alat musik dengan bahan baku sampah, penutup kepala khas Situbondo atau odheng, hingga kerajinan kayu dan kerang.

Hutan bakau atau mangrove, kamu dapat menikmati keindahan kawasan hutan da menyatu dengan alam sambil berjalan di atas jembatan kayu mengitari mangrove.

Matahari terbenam, dengan cafe dan spot foto yang indah para pengunjung dapat berfoto-foto sabil menikmati hari dan melihat matahari terbenam.

Hidangan lokal yang wajib kamu santap ketika berkunjung, yaitu rujak petis yang terdiri dari sayuran dan dicampur sambal manis dengan bahan dasar kacang dan petis udang.

Desa Umbulharjo yang berlokasi di Kecamatan Ponjong, Kabupaten Gunung Kidul terletak sekitar 13km dari pusat Kota Wonosari.

Desa wisata ini menawarkan berbagai pesona keindahan alam yang tidak ada bandingannya yang menjadi objek wisata dan daya tarik wisatawan. Seperti Wadun Beton Indah, Goa Cokro, Goa Gremeng, Goa Plalar, serta Bukit Mardeda Melikan.

Berikut ini beberapa objek wisata di Desa Umbulharjo yang wajib kamu datangi:

Wisata Goa, yang terdiri dari Goa Cokro yang paling terkenal dengan bentuk vertikal dan memiliki kedalaman sekitar 18-meter, Goa Gremeng dan Goa Plalar yang tidak kalah indah dan menawarkan keindahan stalaktit dan stalagmit aktif.

Wadun Beton Indah, yang menjadi salah satu alasan banyak wisatawan datang. Terdapat banyak aktivitas yang dapat dilakukan di sini, mulai dari memancing, outbound, hingga duduk bersantai di warung makan.

Bukit Mardeda Melikan, yang menawarkan keindahan perbukitan bagi para wisatawan yang ingin menikmati keindahan matahari terbit dan terbenam.

Desa selanjutnya yang ada di Distrik Meos Mansar dan menjadi destinasi wisata populer bagi para wisatawan lokal dan mancanegara.

Dengan luas mencapai hingga 7 hektare kamu dapat menikmati pemandangan yang sangat indah, mulai dari pasir putih, laut jernih, hingga rumah warga yang unik.

Arborek juga menawarkan keindahan bawah laut yang tidak kalah indah, para pengunjung dapat melakukan snorkeling untuk menikmati secara langsung kehidupan laut, mulai dari karang hingga ikan berbagai warna dan ukuran.

Desa Mas yang terletak di Ubud, Gianyar, Bali sudah dikenal sejak tahun 1930an sebagai kampung pemahat legendaris di Indonesia hingga mancanegara.

Terdapat beberapa objek wisata yang harus kamu kunjungi ketika berlibur kesini, simak selengkapnya.

Siadja Gallery, yang sudah berdiri sejak tahun 1955 dan menjadi galeri seni pertama di Bali dan Indonesia yang dilengkapi dengan berbagai macam koleksi fine arts, seperti lukisan, pahatan, atau bahkan batik.

Njana Tilem Museum, yang ada di Jalan Raya Mas No. 162. Di sini, para pengunjung dapat menikmati berbagai maha karya dan pemandangan asri dari rumput hijau dan pohon rindang.

Black Hand Gang Printmaking Studio, di mana para pengunjung dapat belajar berbagai teknik cetak grafis serta cetakan sendiri.

Taman Puspa Aman, di mana para pengunjung dapat menanam berbagai bibit tumbuhan, sayuran, hingga obat-obatan.

Nah, itulah penjelasan singkat mengenai apa itu desa wisata, tujuan, karakteristik, hingga contoh desanya.

Bukan hanya sebagai tempat wisata, namun desa wisata memiliki tujuan lain seperti, mendukung program pariwisata pemerintah, pembangunan daerah, memperluas lapangan pekerjaan, dan masih banyak lagi yang dapat bermanfaat bagi masyarakat setempat.

Bagi sahabat MyProtection yang ingin mengunjungi beberapa rekomendasi desa wisata yang ada di Indonesia sangat penting untuk terus merasa aman selama masa perjalanan menggunakan transportasi apa pun.

Untuk itu, MyTravel Protection Domestic dari LGI hadir untuk melindungi kamu dan keluarga dari berbagai risiko ketidaknyamanan perjalanan seperti kecelakaan, kehilangan bagasi, penundaan dan ketidaknyamanan lainnya.

Beberapa keuntungan yang didapatkan dengan menggunakan MyTravel Protection Domestic adalah santunan kecelakaan diri, seperti kematian yang diakibatkan kecelakaan serta cacat total tetap.

Selain itu, biaya medis yang ditimbulkan, santunan tunai harian akibat kecelakaan, evakuasi medis darurat, dan repatriasi.

Bukan hanya itu, terdapat pula keuntungan untuk ketidaknyamanan perjalanan seperti pembatalan perjalanan, penundaan perjalanan, pembajakan pesawat udara, kehilangan bagasi dan barang pribadi, hingga tanggung jawab hukum pribadi.

*PT Lippo General Insurance Tbk berizin dan diawasi oleh Otoritas Jasa Keuangan

Jakarta, 31 Januari 2020 - MyProtection News

Kita sering mendengar bahwa stress membawa dampak buruk bagi diri kita. Dampak negatif stress dapat menyebabkan insomnia, penurunan atau kenaikan berat badan, dan meningkatkan tekanan darah. Namun, Richard Shelton, MD, dari Department of Psychiatry, University of Alabama, Birmingham berpendapat bahwa stress tidak selalu buruk bagi kita (dikutip dari Health.com).

Stress berlebihan atau kronis memang berbahaya bagi kita. Ketika Anda merasa tertekan setiap waktu serta merasa seperti hilang kendali atas hidup, maka stress dapat menganggu kesehatan tubuh dan mental.

Tingkat stress rendah dan sedang yang kita hadapi sehari-hari mempunyai sisi positifnya tersendiri.

Stress tingkat rendah dapat memicu zat kimia dalam otak yang disebut dengan neurotrophins. Zat kimia ini dapat memperkuat koneksi antar neuron di dalam otak. Sehingga Anda bisa berkonsentrasi dengan lebih baik dan lebih produktif. Hal serupa juga ditemukan terjadi pada hewan. Stress tingkat rendah dapat mendorong daya kognitif hewan dalam jangka waktu pendek.

Ketika tubuh merespon terhadap stress, tubuh kita mempersiapkan diri terhadap kemungkinan terjadinya infeksi atau luka. Tubuh memproduksi zat bernama “extra interleukins” yang akan mendorong imunitas tubuh Anda, setidaknya untuk jangka pendek.

Ketika Anda belajar untuk mengatasi situasi yang memicu stress, Anda akan menghadapi situasi yang sama dengan lebih baik di masa depan. Contohnya, tentara SEAL dilatih untuk menghadapi situasi ekstrim. Sehingga ketika menghadapi situasi mendesak yang sesungguhnya, para tentara bisa mengontrol diri mereka untuk tetap tenang.

Good stress atau dikenal sebagai eustress bisa jadi berperan dalam pekerjaan atau studi Anda. Ketika dihadapkan dengan deadline atau ujian, maka otak akan terstimulasi untuk menganalisis situasi dan mengatasi masalah dengan lebih efektif serta produktif. Kuncinya adalah melihat stress sebagai hal tak terhindarkan, bukan sebagai beban yang tidak bisa diatasi.

Mungkin Anda juga pernah merasakannya. Ketika deadline semakin dekat, maka Anda berusaha menyelesaikan pekerjaan dengan lebih efisien. Ketika ada kompetisi di lingkup kerja atau studi, Anda juga bisa terdorong untuk memberikan performa kerja yang lebih baik.

Ternyata, ada juga sisi baik dari stress. Namun, jika Anda merasa stress secara konstan, sebaiknya Anda berkonsultasi dengan tim professional untuk mendapatkan bantuan.

Salam,

Sahabat MyProtection